Business Insurance: Protecting Your Company from Risks

Running a business involves many risks—property damage, legal claims, employee injuries, and more. Business insurance helps protect your company from financial losses caused by these unexpected events, allowing you to focus on growth and success.

This article covers the basics of business insurance and how to choose the right coverage for your company.

What Is Business Insurance?

Business insurance is a set of policies designed to protect businesses from financial losses related to property damage, liability, employee issues, and other operational risks.

Types of Business Insurance

✅ Property Insurance

Covers damage to your business property due to fire, theft, or natural disasters.

✅ Liability Insurance

Protects against claims from third parties for injuries or property damage caused by your business operations.

✅ Workers’ Compensation Insurance

Covers medical expenses and lost wages if employees are injured on the job.

✅ Business Interruption Insurance

Compensates for lost income during periods when your business can’t operate due to covered events.

✅ Professional Liability Insurance

Also known as Errors & Omissions insurance, it protects against claims of negligence or mistakes in professional services.

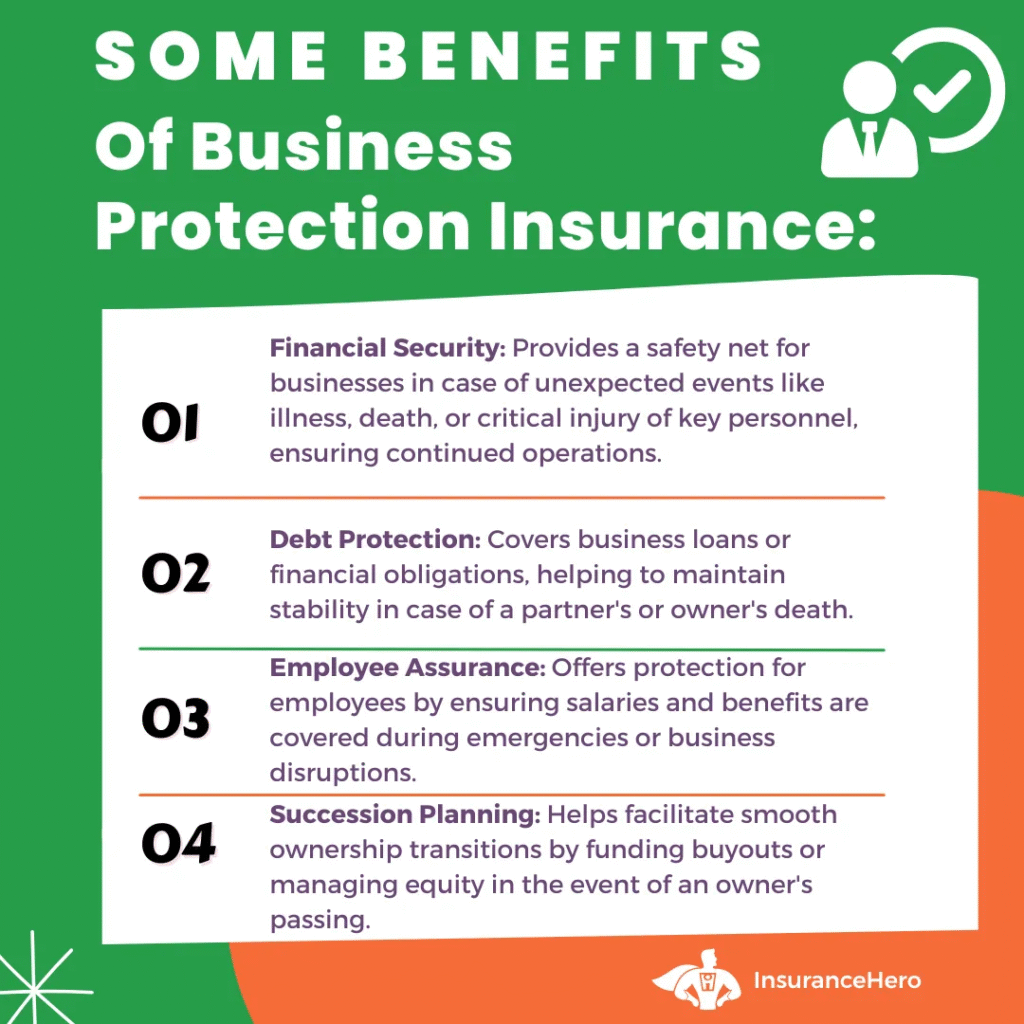

Why Business Insurance Is Important

- 🏢 Safeguards your business assets and property

- ⚖️ Protects against costly lawsuits and legal claims

- 👷 Supports employees in case of work-related injuries

- 💼 Ensures business continuity during disruptions

- 🛡️ Builds trust with clients and partners by showing responsibility

How to Choose the Right Business Insurance

- ✔️ Identify the specific risks your business faces

- ✔️ Determine the coverage limits you need

- ✔️ Compare policies and premiums from multiple insurers

- ✔️ Review claim settlement records and customer service reputation

- ✔️ Consult with an insurance expert for tailored advice

Tips for Managing Business Insurance

- Keep detailed records of assets and employees

- Regularly review and update your policies as your business grows

- Train employees on risk management and safety

- Understand your policy exclusions and conditions

- Pay premiums on time to avoid coverage lapses

Conclusion

Business insurance is a critical part of running a secure and successful company. It protects your investment, your employees, and your reputation. By understanding the types of coverage available and selecting the right policies, you can safeguard your business against unexpected financial challenges and focus on long-term growth.